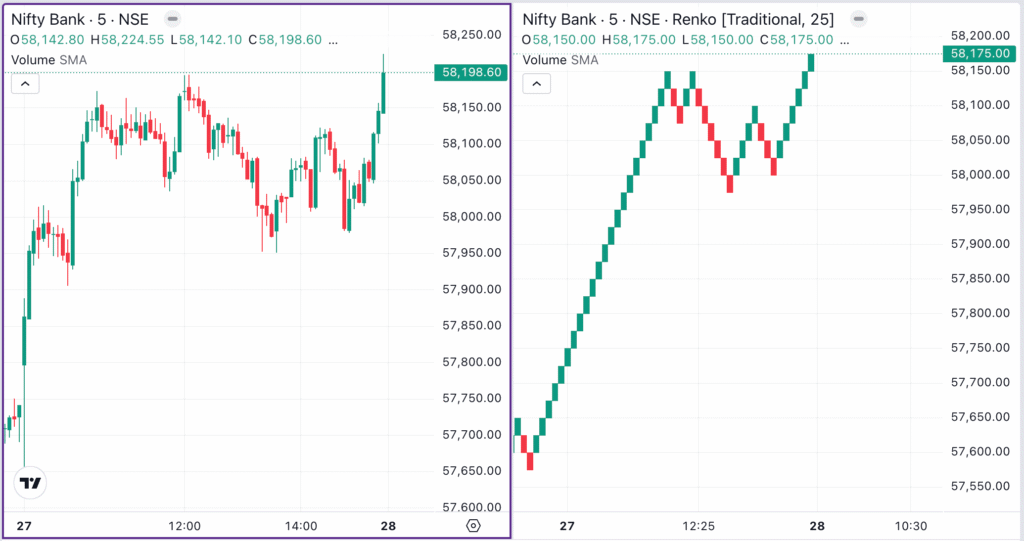

Bank Nifty opened with a gap up today, signalling strong bullish sentiment in the early session. Initially, price action suggested a potential trending day as momentum remained robust, encouraging traders to enter directional positions. However, as the session progressed, buying enthusiasm waned and volatility contracted, resulting in a prolonged sideways market for the remainder of the day. During such phases, trend-following strategies often struggle to generate returns, as the absence of sustained movement limits opportunities for capturing large price swings.

Bank Nifty Chart:

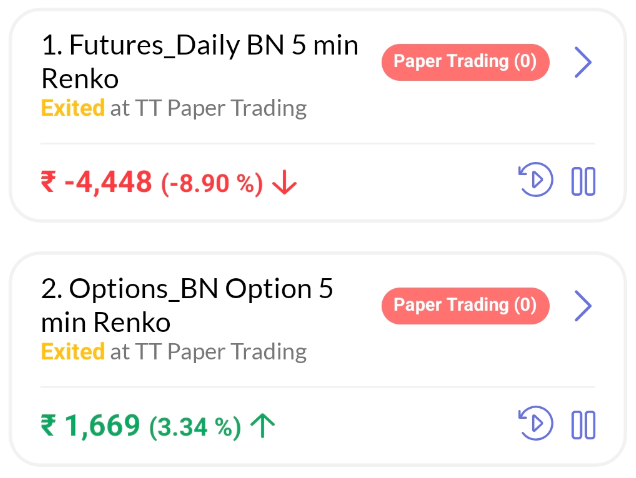

Profit and Loss for Our Simulated Strategies:

- BN Futures 5 min Renko – Total Trades (9) – Profit/Loss (-4448)

- BN ATM Options 5 min Renko – Total Trades (15) – Profit/Loss (+1669)

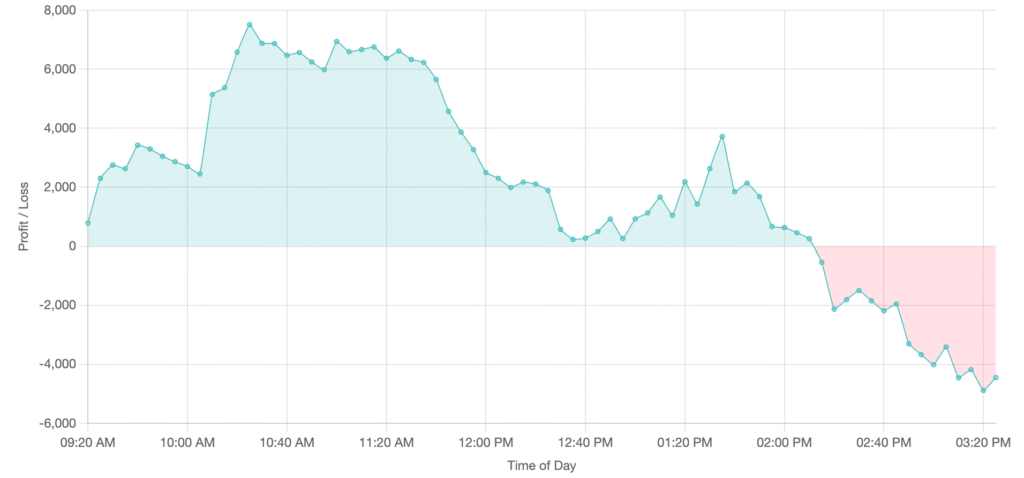

Intraday PnL:

In the morning session, Strategy 1 showed strong profits. However, by the end of the day, the PnL had turned negative. Option premiums eroded rapidly in the sideways market, causing significant losses for option buyers. Since today was one day before the monthly expiry of Bank Nifty options, premium decay accelerated even further, leading to a loss on the trade.

Detailed insights into the strategy can be found here.

Disclaimer: The profit and loss figures provided above are for educational purposes only. Implementing these strategies without adequate knowledge may lead to losses. For more information and guidance, please contact me at: simplestrategieswork@gmail.com